The numbers, however, don’t yet live up to the industry talk. In the broadest terms, roughly 30% of senior officials and managers in the finance and insurance industries were women—roughly 31,000—up slightly from 29% five years ago, according to the latest data from the U.S. Equal Employment Opportunity Commission.

Though women make up more of the industry’s senior leaders, a closer look shows that many are filling corporate functions—human resources, general counsel, investor relations—rather than the revenue-generating businesses that tend to be the proving ground for roles like chief executive or a money manager.

“Those are good jobs. But if you don’t touch the money, you are in a different category,” says Nori Gerardo Lietz, a veteran real estate investor and founder of real estate advisory firm Areté Capital. She also teaches at Harvard Business School.

In an analysis by Equilar of the five highest-paid positions at companies in the Russell 3000 index, financial services had less than 10% of women in these roles—making it the third-worst industry of 11, after energy and communication services. Within finance, banking has made the most progress: Women account for 26% of the top five highest-paid positions in that subgroup, up from 11% in 2010.

Just 5% of S&P 500 index companies had a woman at the helm, and corporate executive committees were less gender diverse in 2019 than in 2018, according to a new report from Bank of America.

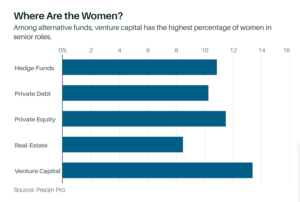

In private markets, the percentage of women in senior positions hasn’t breached the midteens. Venture capital looks the best, with 13.4% of women holding high positions, while real estate looks the worst at 8.5%, according to a Preqin study. A record number of women—54—became partners last year at venture-capital firms with more than $25 million in assets, though two-thirds of such firms still don’t have even one female partner, according to diversity and inclusion nonprofit All Raise.

Those trends are reflected on the other side of the equation, as well. Last year, female-founded start-ups attracted just 2.7% of venture capital, according to PitchBook. Morgan Stanley estimates that venture capital could be leaving $4 trillion on the table by not investing more in women- and minority-owned businesses. More women writing checks could make a difference: Studies have shown that women are twice as likely to invest in companies with female founders and three times as likely to allocate money to firms with a female CEO.

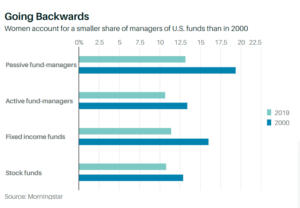

Going BackwardsWomen account for a smaller share of managers of U.S. funds than in 2000

In some instances, the situation has worsened. Only 11% of U.S. fund managers were women in 2019, below the global average of 14% and worse than the 13.9% in 2000, according to a new report from Morningstar. The number of funds has exploded over the past two decades, but the net total of women entering the industry has stayed static, says Madison Sargis, associate director of quantitative research at Morningstar.

Coming into an industry with so few women presents challenges. Laura Geritz, a veteran fund manager who founded female-owned Rondure Global Advisors, says she was told early in her career that she should act more masculine in order to succeed.

“I had to adapt my personality over the years to survive,” Geritz recalls. “I even gamed my score on the Myers-Briggs test so I would test the most like a very dominant male chief investment officer at one of my past firms.”

As it stands, women manage just 1.6% of mutual fund assets. That’s despite numerous studies that have shown their performance is no worse than their male peers and, in some instances, is even better. For example, a 2016 paper co-authored by Northeastern University professors Rajesh Aggarwal and Nicole Boyson found that hedge funds that were still open and had at least one female manager outpaced male-managed funds. That’s consistent with the idea that female managers need to perform better for their funds to stay operative.

Where Are the Women? Among alternative funds, venture capital has the highest percentage of women in senior roles.

In an industry where returns are everything and finding off-the-radar investments is a mission, it’s a puzzling phenomenon.

“A bunch of really good managers are managing less than optimal assets. It’s something asset allocators talk about every day: finding good managers that can generate alpha before everyone else,” says Juan Martinez, the chief financial officer of the Knight Foundation, which has done its own research on diversity in investing.

“There is an enormous culture of opacity, pure bias, and—even more pernicious—incumbency,” says Robert Raben, executive director of the Diverse Asset Managers Initiative and head of consulting and public policy firm The Raben Group.

Data are seen as crucial to overcoming those challenges, but they’re hard to obtain. In a survey by The Raben Group of investment consultants—the gatekeepers between asset managers and investors such as pensions and endowments—just nine of the 30 largest firms provided any diversity data.

Still, Raben sees momentum, with more companies looking to change. A growing body of research illustrating the value of gender diversity is a catalyst. For example, companies with at least 30% women in management have enjoyed higher subsequent one-year returns on equity since 2010, according to research by Bank of America.

One area the industry is focused on is casting a wider net when recruiting. There are signs of progress here: The pool of women seeking a charter from the CFA Institute, a postgraduate professional qualification for investment and finance professionals, has risen to 32% of all candidates, compared with 26% in 2015.

More work needs to be done at the mid-career level, though, as many women drop out of the industry at that point of their working lives. It’s not clear why, but Lietz says it could be because of the internal politicking needed at this juncture in finance careers. Not only do studies show that women are less comfortable with self-promotion, but often they are not in the same networks as their male peers.

“A woman may not get to work with the most powerful partner or be sidelined in an area that doesn’t command the same level of respect within an organization as an area that generates higher returns,” Lietz says. “If you talk about finance, particularly in private markets where your results may not be known for years, it is very relationship-oriented, and networking is very important.”

That bias shows up elsewhere. Despite having track records, seasoned women are sometimes lumped into an emerging managers bucket that may get a token allocation from pensions or endowments, rather than being considered in the mainstream.

But there’s the reason for cautious optimism. Among institutional investors, such as foundations and endowments, the ranks of women are greater than at asset managers, and the share of women doesn’t fall off in the midlevel ranks. Women fill 42.2% of mid-level roles at endowments, 41.6% of junior roles, and 28.2% of senior ones, according to Preqin. Some of those institutional investors, including those applying environmental, social, and corporate governance, or ESG, factors, keep an eye out for diversity when allocating money and asking for more data. In an industry driven by numbers, that may be what finally creates change.

Writer: Reshma Kapadia, BARRON’s

Source credit: https://www.barrons.com/articles/the-case-for-network-monitoring-tools-and-unpacking-apples-app-store-risk-51625867520